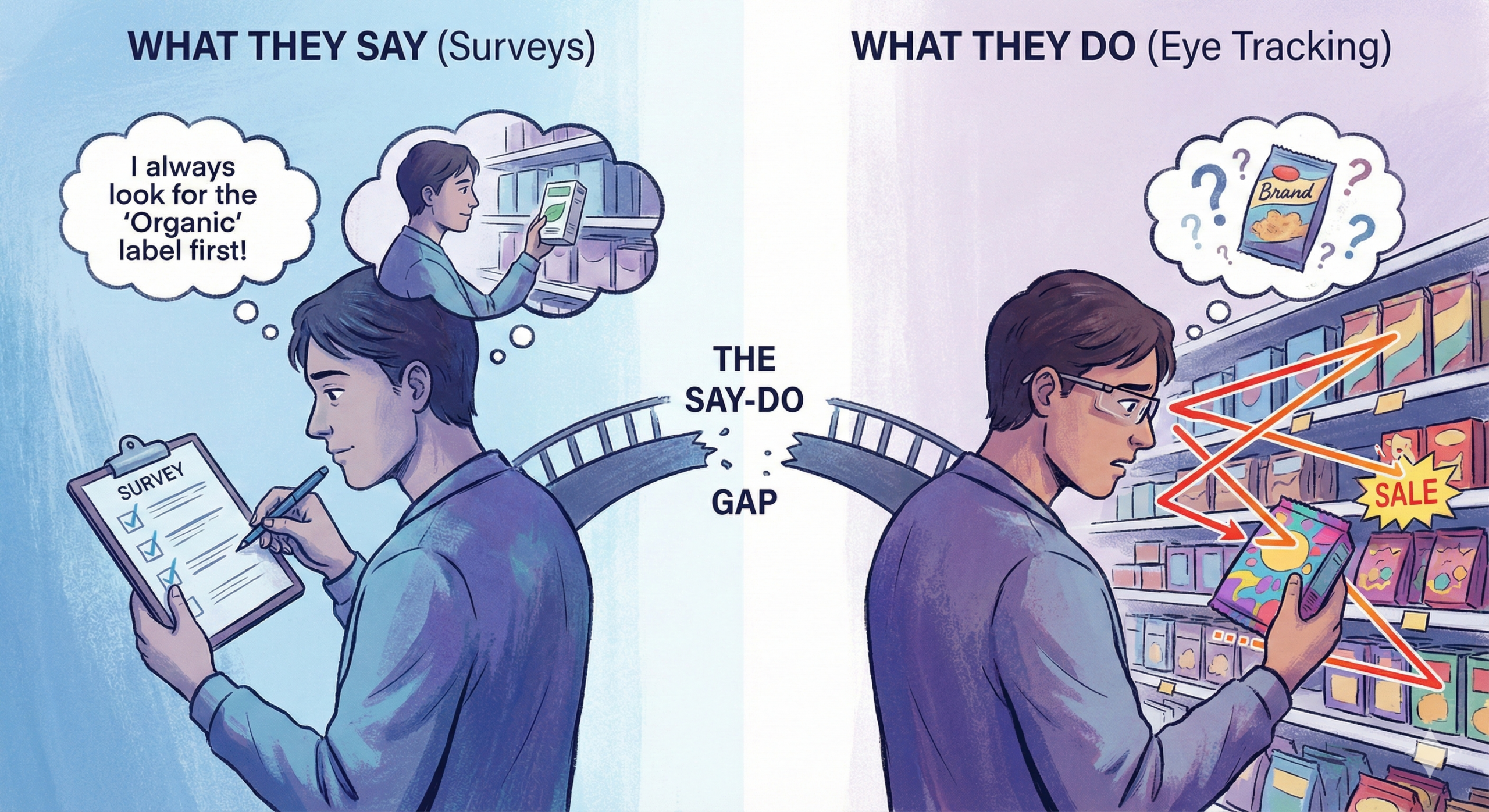

Surveys help understand attitudes, but not behaviours. This is the crux of why most traditional packaging testing falls flat.

Eye-tracking shows that what consumers say is often completely different from what they do.

Where Surveys Fall Short

- Shoppers misremember where they looked

- They overestimate reading

- They underestimate confusion

- They cannot articulate subconscious visual filtering

- They rarely admit “I didn’t notice the product.”

Behavioural Data Tells the Truth

Eye-tracking uncovers:

- Missed fixations

- True claim perception

- Visual clutter issues

- Structural breakdowns in hierarchy

- Actual search patterns

- The elements shoppers rely on (and ignore)

When to Use Each

Use surveys when you need opinions or preferences

Surveys capture what shoppers can consciously report:

- What they think of the design

- Which version do they prefer

- How clear the message feels

- Which messages are more or less important to them

Surveys tell you how people interpret the pack once they’ve seen it.

Use eye tracking when you need real behaviour

Eye tracking shows what shoppers actually notice in the first few seconds:

- Shelf visibility and findability

- Whether key claims are seen

- Visual hierarchy and scan patterns

- The ease of understanding a design

Eye tracking answers the question:

“Did the design earn attention at all?”

Why they work best together

- Eye tracking: reveals what was seen and how easy it is to understand.

- Surveys: explain why they like or dislike a design and what claims are essential.

Attention first. Interpretation second.

That combination gives you a complete picture of real-world packaging performance.

At Rich Insights, we combine both to deliver the strongest, most relevant results possible.

Sources

Nisbett & Wilson (1977). Telling More Than We Can Know.

Wedel & Pieters (2008). Eye Tracking for Visual Marketing.